2019-04-18 23:00:23 +00:00

|

|

|

|

# CTA回测模块

|

2019-08-01 05:01:44 +00:00

|

|

|

|

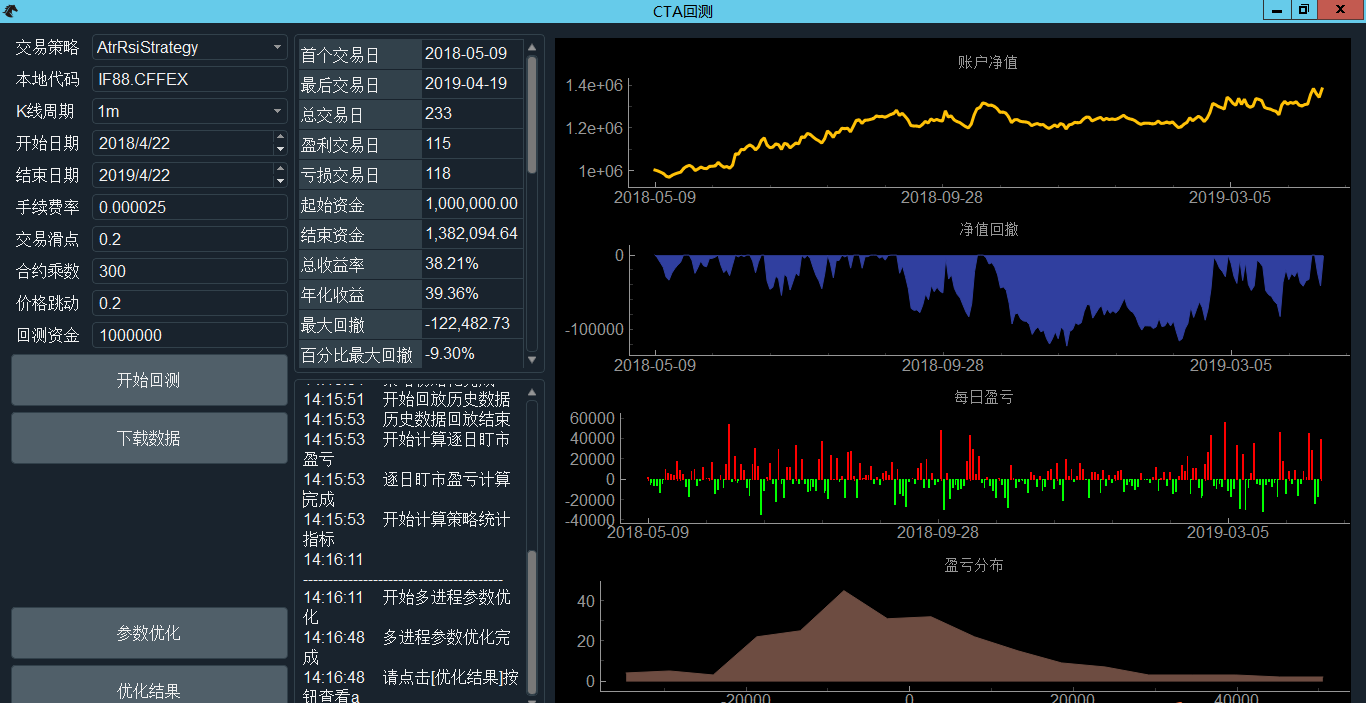

CTA回测模块是基于PyQt5和pyqtgraph的图形化回测工具。启动VN Trader后,在菜单栏中点击“功能-> CTA回测”即可进入该图形化回测界面,如下图。CTA回测模块主要实现3个功能:历史行情数据的下载、策略回测、参数优化、K线图表买卖点展示。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

## 加载启动

|

2019-04-28 06:14:23 +00:00

|

|

|

|

进入图形化回测界面“CTA回测”后,会立刻完成初始化工作:初始化回测引擎、初始化RQData客户端。

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

```

|

|

|

|

|

|

def init_engine(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.write_log("初始化CTA回测引擎")

|

|

|

|

|

|

|

|

|

|

|

|

self.backtesting_engine = BacktestingEngine()

|

|

|

|

|

|

# Redirect log from backtesting engine outside.

|

|

|

|

|

|

self.backtesting_engine.output = self.write_log

|

|

|

|

|

|

|

|

|

|

|

|

self.write_log("策略文件加载完成")

|

|

|

|

|

|

|

|

|

|

|

|

self.init_rqdata()

|

|

|

|

|

|

|

|

|

|

|

|

def init_rqdata(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Init RQData client.

|

|

|

|

|

|

"""

|

|

|

|

|

|

result = rqdata_client.init()

|

|

|

|

|

|

if result:

|

|

|

|

|

|

self.write_log("RQData数据接口初始化成功")

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

## 下载数据

|

2019-04-28 06:14:23 +00:00

|

|

|

|

在开始策略回测之前,必须保证数据库内有充足的历史数据。故vnpy提供了历史数据一键下载的功能。

|

2019-08-01 05:01:44 +00:00

|

|

|

|

|

|

|

|

|

|

### RQData

|

|

|

|

|

|

RQData提供国内股票、ETF、期货以及期权的历史数据。

|

|

|

|

|

|

其下载数据功能主要是基于RQData的get_price()函数实现的。

|

2019-04-23 02:11:42 +00:00

|

|

|

|

```

|

2019-04-28 06:31:49 +00:00

|

|

|

|

get_price(

|

|

|

|

|

|

order_book_ids, start_date='2013-01-04', end_date='2014-01-04',

|

|

|

|

|

|

frequency='1d', fields=None, adjust_type='pre', skip_suspended =False,

|

|

|

|

|

|

market='cn'

|

|

|

|

|

|

)

|

2019-04-23 02:11:42 +00:00

|

|

|

|

```

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

|

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

在使用前要保证RQData初始化完毕,然后填写以下4个字段信息:

|

|

|

|

|

|

- 本地代码:格式为合约品种+交易所,如IF88.CFFEX、rb88.SHFE;然后在底层通过RqdataClient的to_rq_symbol()函数转换成符合RQData格式,对应RQData中get_price()函数的order_book_ids字段。

|

2019-08-01 05:01:44 +00:00

|

|

|

|

- K线周期:可以填1m、1h、d、w,对应get_price()函数的frequency字段。

|

2019-04-23 02:11:42 +00:00

|

|

|

|

- 开始日期:格式为yy/mm/dd,如2017/4/21,对应get_price()函数的start_date字段。(点击窗口右侧箭头按钮可改变日期大小)

|

|

|

|

|

|

- 结束日期:格式为yy/mm/dd,如2019/4/22,对应get_price()函数的end_date字段。(点击窗口右侧箭头按钮可改变日期大小)

|

|

|

|

|

|

|

|

|

|

|

|

填写完字段信息后,点击下方“下载数据”按钮启动下载程序,下载成功如图所示。

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-08-01 05:01:44 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### IB

|

|

|

|

|

|

|

|

|

|

|

|

盈透证券提供外盘股票、期货、期权的历史数据。

|

|

|

|

|

|

下载前必须连接好IB接口,因为其下载数据功能主要是基于IbGateway类query_history()函数实现的。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def query_history(self, req: HistoryRequest):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.history_req = req

|

|

|

|

|

|

|

|

|

|

|

|

self.reqid += 1

|

|

|

|

|

|

|

|

|

|

|

|

ib_contract = Contract()

|

|

|

|

|

|

ib_contract.conId = str(req.symbol)

|

|

|

|

|

|

ib_contract.exchange = EXCHANGE_VT2IB[req.exchange]

|

|

|

|

|

|

|

|

|

|

|

|

if req.end:

|

|

|

|

|

|

end = req.end

|

|

|

|

|

|

end_str = end.strftime("%Y%m%d %H:%M:%S")

|

|

|

|

|

|

else:

|

|

|

|

|

|

end = datetime.now()

|

|

|

|

|

|

end_str = ""

|

|

|

|

|

|

|

|

|

|

|

|

delta = end - req.start

|

|

|

|

|

|

days = min(delta.days, 180) # IB only provides 6-month data

|

|

|

|

|

|

duration = f"{days} D"

|

|

|

|

|

|

bar_size = INTERVAL_VT2IB[req.interval]

|

|

|

|

|

|

|

|

|

|

|

|

if req.exchange == Exchange.IDEALPRO:

|

|

|

|

|

|

bar_type = "MIDPOINT"

|

|

|

|

|

|

else:

|

|

|

|

|

|

bar_type = "TRADES"

|

|

|

|

|

|

|

|

|

|

|

|

self.client.reqHistoricalData(

|

|

|

|

|

|

self.reqid,

|

|

|

|

|

|

ib_contract,

|

|

|

|

|

|

end_str,

|

|

|

|

|

|

duration,

|

|

|

|

|

|

bar_size,

|

|

|

|

|

|

bar_type,

|

|

|

|

|

|

1,

|

|

|

|

|

|

1,

|

|

|

|

|

|

False,

|

|

|

|

|

|

[]

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

self.history_condition.acquire() # Wait for async data return

|

|

|

|

|

|

self.history_condition.wait()

|

|

|

|

|

|

self.history_condition.release()

|

|

|

|

|

|

|

|

|

|

|

|

history = self.history_buf

|

|

|

|

|

|

self.history_buf = [] # Create new buffer list

|

|

|

|

|

|

self.history_req = None

|

|

|

|

|

|

|

|

|

|

|

|

return history

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### BITMEX

|

|

|

|

|

|

|

|

|

|

|

|

BITMEX交易所提供数字货币历史数据。

|

|

|

|

|

|

由于仿真环境与实盘环境行情差异比较大,故需要用实盘账号登录BIMEX接口来下载真实行情数据,其下载数据功能主要是基于BitmexGateway类query_history()函数实现的。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def query_history(self, req: HistoryRequest):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

if not self.check_rate_limit():

|

|

|

|

|

|

return

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-08-01 05:01:44 +00:00

|

|

|

|

history = []

|

|

|

|

|

|

count = 750

|

|

|

|

|

|

start_time = req.start.isoformat()

|

|

|

|

|

|

|

|

|

|

|

|

while True:

|

|

|

|

|

|

# Create query params

|

|

|

|

|

|

params = {

|

|

|

|

|

|

"binSize": INTERVAL_VT2BITMEX[req.interval],

|

|

|

|

|

|

"symbol": req.symbol,

|

|

|

|

|

|

"count": count,

|

|

|

|

|

|

"startTime": start_time

|

|

|

|

|

|

}

|

|

|

|

|

|

|

|

|

|

|

|

# Add end time if specified

|

|

|

|

|

|

if req.end:

|

|

|

|

|

|

params["endTime"] = req.end.isoformat()

|

|

|

|

|

|

|

|

|

|

|

|

# Get response from server

|

|

|

|

|

|

resp = self.request(

|

|

|

|

|

|

"GET",

|

|

|

|

|

|

"/trade/bucketed",

|

|

|

|

|

|

params=params

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

# Break if request failed with other status code

|

|

|

|

|

|

if resp.status_code // 100 != 2:

|

|

|

|

|

|

msg = f"获取历史数据失败,状态码:{resp.status_code},信息:{resp.text}"

|

|

|

|

|

|

self.gateway.write_log(msg)

|

|

|

|

|

|

break

|

|

|

|

|

|

else:

|

|

|

|

|

|

data = resp.json()

|

|

|

|

|

|

if not data:

|

|

|

|

|

|

msg = f"获取历史数据为空,开始时间:{start_time},数量:{count}"

|

|

|

|

|

|

break

|

|

|

|

|

|

|

|

|

|

|

|

for d in data:

|

|

|

|

|

|

dt = datetime.strptime(

|

|

|

|

|

|

d["timestamp"], "%Y-%m-%dT%H:%M:%S.%fZ")

|

|

|

|

|

|

bar = BarData(

|

|

|

|

|

|

symbol=req.symbol,

|

|

|

|

|

|

exchange=req.exchange,

|

|

|

|

|

|

datetime=dt,

|

|

|

|

|

|

interval=req.interval,

|

|

|

|

|

|

volume=d["volume"],

|

|

|

|

|

|

open_price=d["open"],

|

|

|

|

|

|

high_price=d["high"],

|

|

|

|

|

|

low_price=d["low"],

|

|

|

|

|

|

close_price=d["close"],

|

|

|

|

|

|

gateway_name=self.gateway_name

|

|

|

|

|

|

)

|

|

|

|

|

|

history.append(bar)

|

|

|

|

|

|

|

|

|

|

|

|

begin = data[0]["timestamp"]

|

|

|

|

|

|

end = data[-1]["timestamp"]

|

|

|

|

|

|

msg = f"获取历史数据成功,{req.symbol} - {req.interval.value},{begin} - {end}"

|

|

|

|

|

|

self.gateway.write_log(msg)

|

|

|

|

|

|

|

|

|

|

|

|

# Break if total data count less than 750 (latest date collected)

|

|

|

|

|

|

if len(data) < 750:

|

|

|

|

|

|

break

|

|

|

|

|

|

|

|

|

|

|

|

# Update start time

|

|

|

|

|

|

start_time = bar.datetime + TIMEDELTA_MAP[req.interval]

|

|

|

|

|

|

|

|

|

|

|

|

return history

|

|

|

|

|

|

```

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

## 策略回测

|

2019-04-28 06:14:23 +00:00

|

|

|

|

下载完历史数据后,需要配置以下字段:交易策略、手续费率、交易滑点、合约乘数、价格跳动、回测资金。

|

|

|

|

|

|

这些字段主要对应BacktesterEngine类的run_backtesting函数。

|

2019-08-01 05:01:44 +00:00

|

|

|

|

|

|

|

|

|

|

若数据库已存在历史数据,无需重复下载,直接从本地数据库中导入数据进行回测。注意,vt_symbol的格式为品种代码.交易所的形式,如IF1908.CFFEX,导入时会自动将其分割为品种和交易所两部分

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

```

|

2019-04-28 06:31:49 +00:00

|

|

|

|

def run_backtesting(

|

|

|

|

|

|

self, class_name: str, vt_symbol: str, interval: str, start: datetime,

|

|

|

|

|

|

end: datetime, rate: float, slippage: float, size: int, pricetick: float,

|

|

|

|

|

|

capital: int, setting: dict

|

|

|

|

|

|

):

|

2019-04-28 06:14:23 +00:00

|

|

|

|

```

|

2019-08-01 05:01:44 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

点击下方的“开始回测”按钮可以开始回测:

|

|

|

|

|

|

首先会弹出如图所示的参数配置窗口,用于调整策略参数。该设置对应的是run_backtesting()函数的setting字典。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

点击“确认”按钮后开始运行回测,同时日志界面会输出相关信息,如图。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

回测完成后会显示统计数字图表。

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

### 统计数据

|

2019-04-28 06:31:49 +00:00

|

|

|

|

用于显示回测完成后的相关统计数值, 如结束资金、总收益率、夏普比率、收益回撤比。

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

### 图表分析

|

2019-04-28 06:14:23 +00:00

|

|

|

|

以下四个图分别是代表账号净值、净值回撤、每日盈亏、盈亏分布。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

|

|

|

|

|

|

2019-08-01 05:01:44 +00:00

|

|

|

|

|

|

|

|

|

|

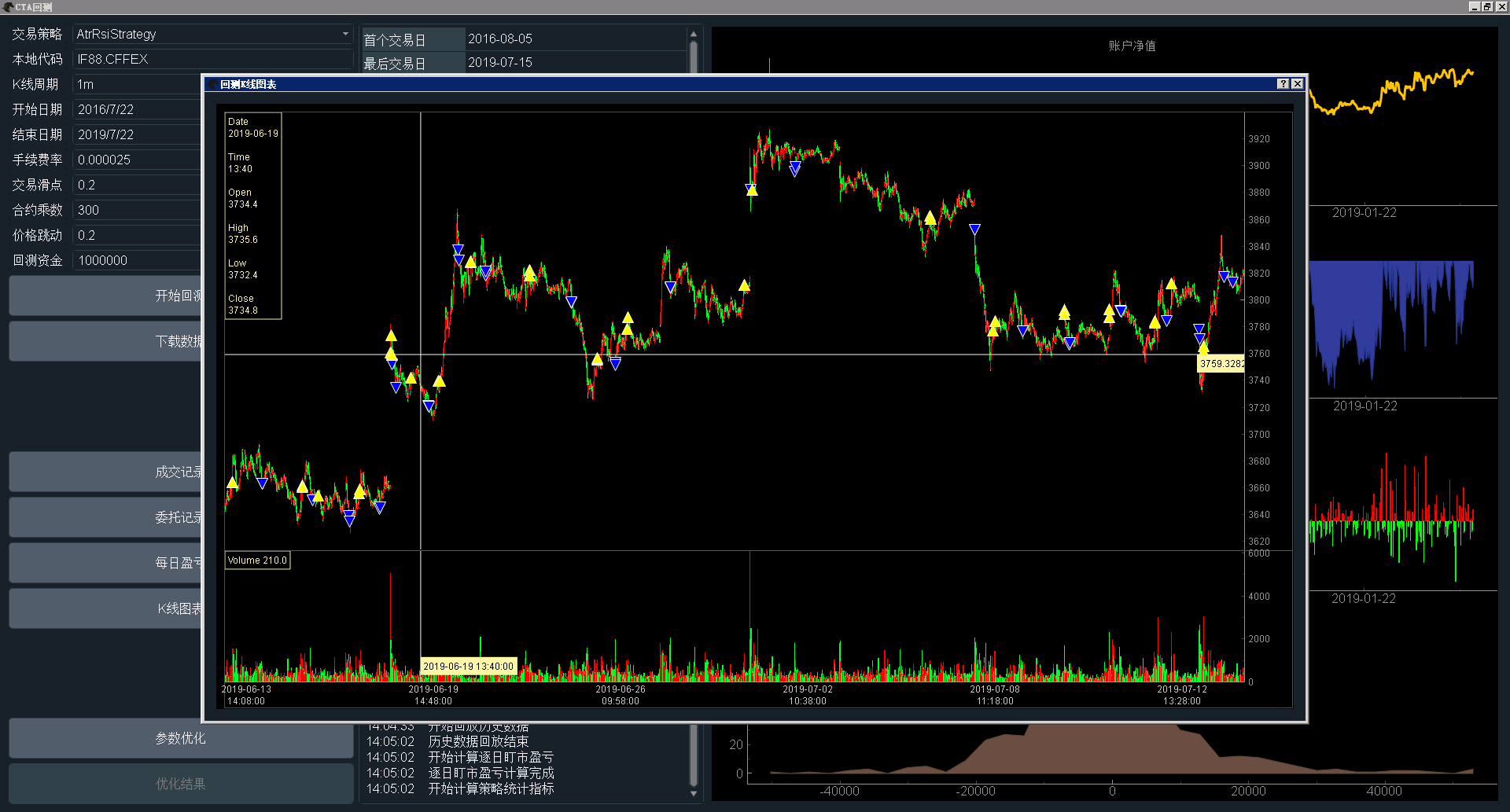

### K线图

|

|

|

|

|

|

K线图是基于PyQtGraph开发的,整个模块由以下五大组件构成:

|

|

|

|

|

|

|

|

|

|

|

|

- BarManager:K线序列数据管理工具

|

|

|

|

|

|

- ChartItem:基础图形类,继承实现后可以绘制K线、成交量、技术指标等

|

|

|

|

|

|

- DatetimeAxis:针对K线时间戳设计的定制坐标轴

|

|

|

|

|

|

- ChartCursor:十字光标控件,用于显示特定位置的数据细节

|

|

|

|

|

|

- ChartWidget:包含以上所有部分,提供单一函数入口的绘图组件

|

|

|

|

|

|

|

|

|

|

|

|

在回测完毕后,点击“K线图表”按钮即可显示历史K线行情数据(默认1分钟),并且标识有具体的买卖点位,如下图。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-23 02:11:42 +00:00

|

|

|

|

|

2019-04-29 06:32:53 +00:00

|

|

|

|

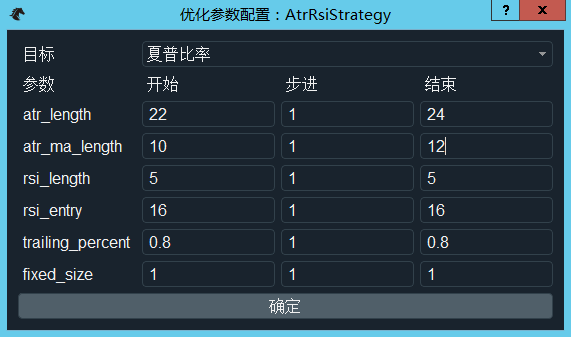

## 参数优化

|

2019-05-08 14:18:56 +00:00

|

|

|

|

vnpy提供2种参数优化的解决方案:穷举算法、遗传算法

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

2019-05-08 14:18:56 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### 穷举算法

|

|

|

|

|

|

|

|

|

|

|

|

穷举算法原理:

|

|

|

|

|

|

- 输入需要优化的参数名、优化区间、优化步进,以及优化目标。

|

|

|

|

|

|

```

|

|

|

|

|

|

def add_parameter(

|

|

|

|

|

|

self, name: str, start: float, end: float = None, step: float = None

|

|

|

|

|

|

):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

if not end and not step:

|

|

|

|

|

|

self.params[name] = [start]

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

if start >= end:

|

|

|

|

|

|

print("参数优化起始点必须小于终止点")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

if step <= 0:

|

|

|

|

|

|

print("参数优化步进必须大于0")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

value = start

|

|

|

|

|

|

value_list = []

|

|

|

|

|

|

|

|

|

|

|

|

while value <= end:

|

|

|

|

|

|

value_list.append(value)

|

|

|

|

|

|

value += step

|

|

|

|

|

|

|

|

|

|

|

|

self.params[name] = value_list

|

|

|

|

|

|

|

|

|

|

|

|

def set_target(self, target_name: str):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.target_name = target_name

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 形成全局参数组合, 数据结构为[{key: value, key: value}, {key: value, key: value}]。

|

|

|

|

|

|

```

|

|

|

|

|

|

def generate_setting(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

keys = self.params.keys()

|

|

|

|

|

|

values = self.params.values()

|

|

|

|

|

|

products = list(product(*values))

|

|

|

|

|

|

|

|

|

|

|

|

settings = []

|

|

|

|

|

|

for p in products:

|

|

|

|

|

|

setting = dict(zip(keys, p))

|

|

|

|

|

|

settings.append(setting)

|

|

|

|

|

|

|

|

|

|

|

|

return settings

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 遍历全局中的每一个参数组合:遍历的过程即运行一次策略回测,并且返回优化目标数值;然后根据目标数值排序,输出优化结果。

|

|

|

|

|

|

```

|

|

|

|

|

|

def run_optimization(self, optimization_setting: OptimizationSetting, output=True):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

# Get optimization setting and target

|

|

|

|

|

|

settings = optimization_setting.generate_setting()

|

|

|

|

|

|

target_name = optimization_setting.target_name

|

|

|

|

|

|

|

|

|

|

|

|

if not settings:

|

|

|

|

|

|

self.output("优化参数组合为空,请检查")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

if not target_name:

|

|

|

|

|

|

self.output("优化目标未设置,请检查")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

# Use multiprocessing pool for running backtesting with different setting

|

|

|

|

|

|

pool = multiprocessing.Pool(multiprocessing.cpu_count())

|

|

|

|

|

|

|

|

|

|

|

|

results = []

|

|

|

|

|

|

for setting in settings:

|

|

|

|

|

|

result = (pool.apply_async(optimize, (

|

|

|

|

|

|

target_name,

|

|

|

|

|

|

self.strategy_class,

|

|

|

|

|

|

setting,

|

|

|

|

|

|

self.vt_symbol,

|

|

|

|

|

|

self.interval,

|

|

|

|

|

|

self.start,

|

|

|

|

|

|

self.rate,

|

|

|

|

|

|

self.slippage,

|

|

|

|

|

|

self.size,

|

|

|

|

|

|

self.pricetick,

|

|

|

|

|

|

self.capital,

|

|

|

|

|

|

self.end,

|

|

|

|

|

|

self.mode

|

|

|

|

|

|

)))

|

|

|

|

|

|

results.append(result)

|

|

|

|

|

|

|

|

|

|

|

|

pool.close()

|

|

|

|

|

|

pool.join()

|

|

|

|

|

|

|

|

|

|

|

|

# Sort results and output

|

|

|

|

|

|

result_values = [result.get() for result in results]

|

|

|

|

|

|

result_values.sort(reverse=True, key=lambda result: result[1])

|

|

|

|

|

|

|

|

|

|

|

|

if output:

|

|

|

|

|

|

for value in result_values:

|

|

|

|

|

|

msg = f"参数:{value[0]}, 目标:{value[1]}"

|

|

|

|

|

|

self.output(msg)

|

|

|

|

|

|

|

|

|

|

|

|

return result_values

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

注意:可以使用multiprocessing库来创建多进程实现并行优化。例如:若用户计算机是2核,优化时间为原来1/2;若计算机是10核,优化时间为原来1/10。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

穷举算法操作:

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-28 06:31:49 +00:00

|

|

|

|

- 点击“参数优化”按钮,会弹出“优化参数配置”窗口,用于设置优化目标(如最大化夏普比率、最大化收益回撤比)和设置需要优化的参数以及优化区间,如图。

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 设置好需要优化的参数后,点击“优化参数配置”窗口下方的“确认”按钮开始进行调用CPU多核进行多进程并行优化,同时日志会输出相关信息。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

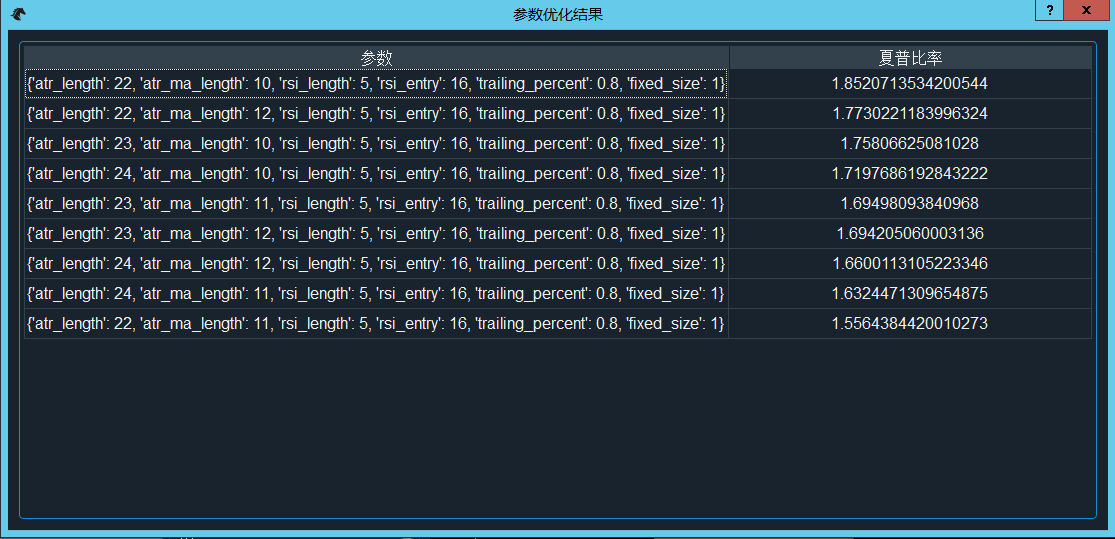

- 点击“优化结果”按钮可以看出优化结果,如图的参数组合是基于目标数值(夏普比率)由高到低的顺序排列的。

|

2019-04-28 06:31:49 +00:00

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-05-08 14:18:56 +00:00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### 遗传算法

|

|

|

|

|

|

|

|

|

|

|

|

遗传算法原理:

|

|

|

|

|

|

|

|

|

|

|

|

- 输入需要优化的参数名、优化区间、优化步进,以及优化目标;

|

|

|

|

|

|

|

2019-05-09 02:10:42 +00:00

|

|

|

|

- 形成全局参数组合,该组合的数据结构是列表内镶嵌元组,即\[[(key, value), (key, value)] , [(key, value), (key,value)]],与穷举算法的全局参数组合的数据结构不同。这样做的目的是有利于参数间进行交叉互换和变异。

|

2019-05-08 14:18:56 +00:00

|

|

|

|

```

|

|

|

|

|

|

def generate_setting_ga(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

settings_ga = []

|

|

|

|

|

|

settings = self.generate_setting()

|

|

|

|

|

|

for d in settings:

|

|

|

|

|

|

param = [tuple(i) for i in d.items()]

|

|

|

|

|

|

settings_ga.append(param)

|

|

|

|

|

|

return settings_ga

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 形成个体:调用random()函数随机从全局参数组合中获取参数。

|

|

|

|

|

|

```

|

|

|

|

|

|

def generate_parameter():

|

|

|

|

|

|

""""""

|

|

|

|

|

|

return random.choice(settings)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 定义个体变异规则: 即发生变异时,旧的个体完全被新的个体替代。

|

|

|

|

|

|

```

|

|

|

|

|

|

def mutate_individual(individual, indpb):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

size = len(individual)

|

|

|

|

|

|

paramlist = generate_parameter()

|

|

|

|

|

|

for i in range(size):

|

|

|

|

|

|

if random.random() < indpb:

|

|

|

|

|

|

individual[i] = paramlist[i]

|

|

|

|

|

|

return individual,

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 定义评估函数:入参的是个体,即[(key, value), (key, value)]形式的参数组合,然后通过dict()转化成setting字典,然后运行回测,输出目标优化数值,如夏普比率、收益回撤比。(注意,修饰器@lru_cache作用是缓存计算结果,避免遇到相同的输入重复计算,大大降低运行遗传算法的时间)

|

|

|

|

|

|

```

|

|

|

|

|

|

@lru_cache(maxsize=1000000)

|

|

|

|

|

|

def _ga_optimize(parameter_values: tuple):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

setting = dict(parameter_values)

|

|

|

|

|

|

|

|

|

|

|

|

result = optimize(

|

|

|

|

|

|

ga_target_name,

|

|

|

|

|

|

ga_strategy_class,

|

|

|

|

|

|

setting,

|

|

|

|

|

|

ga_vt_symbol,

|

|

|

|

|

|

ga_interval,

|

|

|

|

|

|

ga_start,

|

|

|

|

|

|

ga_rate,

|

|

|

|

|

|

ga_slippage,

|

|

|

|

|

|

ga_size,

|

|

|

|

|

|

ga_pricetick,

|

|

|

|

|

|

ga_capital,

|

|

|

|

|

|

ga_end,

|

|

|

|

|

|

ga_mode

|

|

|

|

|

|

)

|

|

|

|

|

|

return (result[1],)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

def ga_optimize(parameter_values: list):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

return _ga_optimize(tuple(parameter_values))

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 运行遗传算法:调用deap库的算法引擎来运行遗传算法,其具体流程如下。

|

|

|

|

|

|

1)先定义优化方向,如夏普比率最大化;

|

|

|

|

|

|

2)然后随机从全局参数组合获取个体,并形成族群;

|

|

|

|

|

|

3)对族群内所有个体进行评估(即运行回测),并且剔除表现不好个体;

|

|

|

|

|

|

4)剩下的个体会进行交叉或者变异,通过评估和筛选后形成新的族群;(到此为止是完整的一次种群迭代过程);

|

|

|

|

|

|

5)多次迭代后,种群内差异性减少,整体适应性提高,最终输出建议结果。该结果为帕累托解集,可以是1个或者多个参数组合。

|

|

|

|

|

|

|

|

|

|

|

|

注意:由于用到了@lru_cache, 迭代中后期的速度回提高非常多,因为很多重复的输入都避免了再次的回测,直接在内存中查询并且返回计算结果。

|

|

|

|

|

|

```

|

|

|

|

|

|

from deap import creator, base, tools, algorithms

|

|

|

|

|

|

creator.create("FitnessMax", base.Fitness, weights=(1.0,))

|

|

|

|

|

|

creator.create("Individual", list, fitness=creator.FitnessMax)

|

|

|

|

|

|

......

|

|

|

|

|

|

# Set up genetic algorithem

|

|

|

|

|

|

toolbox = base.Toolbox()

|

|

|

|

|

|

toolbox.register("individual", tools.initIterate, creator.Individual, generate_parameter)

|

|

|

|

|

|

toolbox.register("population", tools.initRepeat, list, toolbox.individual)

|

|

|

|

|

|

toolbox.register("mate", tools.cxTwoPoint)

|

|

|

|

|

|

toolbox.register("mutate", mutate_individual, indpb=1)

|

|

|

|

|

|

toolbox.register("evaluate", ga_optimize)

|

|

|

|

|

|

toolbox.register("select", tools.selNSGA2)

|

|

|

|

|

|

|

|

|

|

|

|

total_size = len(settings)

|

|

|

|

|

|

pop_size = population_size # number of individuals in each generation

|

|

|

|

|

|

lambda_ = pop_size # number of children to produce at each generation

|

|

|

|

|

|

mu = int(pop_size * 0.8) # number of individuals to select for the next generation

|

|

|

|

|

|

|

|

|

|

|

|

cxpb = 0.95 # probability that an offspring is produced by crossover

|

|

|

|

|

|

mutpb = 1 - cxpb # probability that an offspring is produced by mutation

|

|

|

|

|

|

ngen = ngen_size # number of generation

|

|

|

|

|

|

|

|

|

|

|

|

pop = toolbox.population(pop_size)

|

|

|

|

|

|

hof = tools.ParetoFront() # end result of pareto front

|

|

|

|

|

|

|

|

|

|

|

|

stats = tools.Statistics(lambda ind: ind.fitness.values)

|

|

|

|

|

|

np.set_printoptions(suppress=True)

|

|

|

|

|

|

stats.register("mean", np.mean, axis=0)

|

|

|

|

|

|

stats.register("std", np.std, axis=0)

|

|

|

|

|

|

stats.register("min", np.min, axis=0)

|

|

|

|

|

|

stats.register("max", np.max, axis=0)

|

|

|

|

|

|

|

|

|

|

|

|

algorithms.eaMuPlusLambda(

|

|

|

|

|

|

pop,

|

|

|

|

|

|

toolbox,

|

|

|

|

|

|

mu,

|

|

|

|

|

|

lambda_,

|

|

|

|

|

|

cxpb,

|

|

|

|

|

|

mutpb,

|

|

|

|

|

|

ngen,

|

|

|

|

|

|

stats,

|

|

|

|

|

|

halloffame=hof

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

# Return result list

|

|

|

|

|

|

results = []

|

|

|

|

|

|

|

|

|

|

|

|

for parameter_values in hof:

|

|

|

|

|

|

setting = dict(parameter_values)

|

|

|

|

|

|

target_value = ga_optimize(parameter_values)[0]

|

|

|

|

|

|

results.append((setting, target_value, {}))

|

|

|

|

|

|

|

|

|

|

|

|

return results

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-28 06:14:23 +00:00

|

|

|

|

|

2019-04-18 23:00:23 +00:00

|

|

|

|

|

|

|

|

|

|

|