2019-04-02 08:50:43 +00:00

|

|

|

|

# CTA策略模块

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-28 13:34:51 +00:00

|

|

|

|

## 模块构成

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

CTA策略模块主要由7部分构成,如下图:

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

- base:定义了CTA模块中用到的一些基础设置,如引擎类型(回测/实盘)、回测模式(K线/Tick)、本地停止单的定义以及停止单状态(等待中/已撤销/已触发)。

|

|

|

|

|

|

|

|

|

|

|

|

- template:定义了CTA策略模板(包含信号生成和委托管理)、CTA信号(仅负责信号生成)、目标仓位算法(仅负责委托管理,适用于拆分巨型委托,降低冲击成本)。

|

|

|

|

|

|

- strategies: 官方提供的cta策略示例,包含从最基础的双均线策略,到通道突破类型的布林带策略,到跨时间周期策略,再到把信号生成和委托管理独立开来的多信号策略。

|

|

|

|

|

|

- backesting:包含回测引擎和参数优化。其中回测引擎定义了数据载入、委托撮合机制、计算与统计相关盈利指标、结果绘图等函数。

|

|

|

|

|

|

- converter:定义了针对上期所品种平今/平昨模式的委托转换模块;对于其他品种用户也可以通过可选参数lock切换至锁仓模式。

|

|

|

|

|

|

- engine:定义了CTA策略实盘引擎,其中包括:RQData客户端初始化和数据载入、策略的初始化和启动、推送Tick订阅行情到策略中、挂撤单操作、策略的停止和移除等。

|

|

|

|

|

|

- ui:基于PyQt5的GUI图形应用。

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

## 历史数据

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 回测历史数据

|

|

|

|

|

|

回测所需要的历史数据可通过运行getdata.py文件进行下载。该文件处于根目录下tests\backtesting文件夹内。

|

|

|

|

|

|

下载历史数据的原理是调用RQData的get_price()函数把数据下载到内存里面;再通过generate_bar_from_row()函数,以固定格式把数据从内存载入到硬盘数据库中。

|

|

|

|

|

|

|

|

|

|

|

|

下面介绍具体流程:

|

|

|

|

|

|

|

|

|

|

|

|

- 填写RQData的账号密码,初始化RQData

|

|

|

|

|

|

```

|

|

|

|

|

|

import rqdatac as rq

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USERNAME = ""

|

|

|

|

|

|

PASSWORD = ""

|

|

|

|

|

|

FIELDS = ["open", "high", "low", "close", "volume"]

|

|

|

|

|

|

|

|

|

|

|

|

rq.init(USERNAME, PASSWORD, ("rqdatad-pro.ricequant.com", 16011))

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 定义数据插入格式。需要插入的数据包括:合约代码、交易所、K线周期、开盘价、最高价、最低价、收盘价、成交量、数据库名称、vt_symbol(注意:K线周期可以是"1m"、"1h"、"d"、"w"。to_pydatetime()用于时间转换成datetime格式)

|

|

|

|

|

|

```

|

|

|

|

|

|

def generate_bar_from_row(row, symbol, exchange):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

bar = DbBarData()

|

|

|

|

|

|

|

|

|

|

|

|

bar.symbol = symbol

|

|

|

|

|

|

bar.exchange = exchange

|

|

|

|

|

|

bar.interval = "1m"

|

|

|

|

|

|

bar.open_price = row["open"]

|

|

|

|

|

|

bar.high_price = row["high"]

|

|

|

|

|

|

bar.low_price = row["low"]

|

|

|

|

|

|

bar.close_price = row["close"]

|

|

|

|

|

|

bar.volume = row["volume"]

|

|

|

|

|

|

bar.datetime = row.name.to_pydatetime()

|

|

|

|

|

|

bar.gateway_name = "DB"

|

|

|

|

|

|

bar.vt_symbol = f"{symbol}.{exchange}"

|

|

|

|

|

|

|

|

|

|

|

|

return bar

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 定义数据下载函数。主要调用RQData的get_price()获取指定合约或合约列表的历史数据(包含起止日期,日线或分钟线)。目前仅支持中国市场的股票、期货、ETF和上金所现货的行情数据,如黄金、铂金和白银产品。(注意:起始日期默认是2013-01-04,结束日期默认是2014-01-04)

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def download_minute_bar(vt_symbol):

|

|

|

|

|

|

"""下载某一合约的分钟线数据"""

|

|

|

|

|

|

print(f"开始下载合约数据{vt_symbol}")

|

|

|

|

|

|

symbol, exchange = vt_symbol.split(".")

|

|

|

|

|

|

|

|

|

|

|

|

start = time()

|

|

|

|

|

|

|

|

|

|

|

|

df = rq.get_price(symbol, start_date="2018-01-01", end_date="2019-01-01", frequency="1m", fields=FIELDS)

|

|

|

|

|

|

|

|

|

|

|

|

with DB.atomic():

|

|

|

|

|

|

for ix, row in df.iterrows():

|

|

|

|

|

|

print(row.name)

|

|

|

|

|

|

bar = generate_bar_from_row(row, symbol, exchange)

|

|

|

|

|

|

DbBarData.replace(bar.__data__).execute()

|

|

|

|

|

|

|

|

|

|

|

|

end = time()

|

|

|

|

|

|

cost = (end - start) * 1000

|

|

|

|

|

|

|

|

|

|

|

|

print(

|

|

|

|

|

|

"合约%s的分钟K线数据下载完成%s - %s,耗时%s毫秒"

|

|

|

|

|

|

% (symbol, df.index[0], df.index[-1], cost)

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### 实盘历史数据

|

|

|

|

|

|

在实盘中,RQData通过实时载入数据进行策略的初始化。该功能主要在CTA实盘引擎engine.py内实现。

|

|

|

|

|

|

下面介绍具体流程:

|

|

|

|

|

|

- 配置json文件:在用户目录下.vntrader文件夹找到vt_setting.json,输入RQData的账号和密码,如图。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 初始化RQData客户端:从vt_setting.json中读取RQData的账户、密码到rq_client.init()函数进行初始化

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def init_rqdata(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Init RQData client.

|

|

|

|

|

|

"""

|

|

|

|

|

|

username = SETTINGS["rqdata.username"]

|

|

|

|

|

|

password = SETTINGS["rqdata.password"]

|

|

|

|

|

|

if not username or not password:

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

import rqdatac

|

|

|

|

|

|

|

|

|

|

|

|

self.rq_client = rqdatac

|

|

|

|

|

|

self.rq_client.init(username, password,

|

|

|

|

|

|

('rqdatad-pro.ricequant.com', 16011))

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- RQData载入实盘数据:输入vt_symbol后,首先会转换成符合RQData格式的rq_symbol,通过get_price()函数下载数据,并且插入到数据库中。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def query_bar_from_rq(

|

|

|

|

|

|

self, vt_symbol: str, interval: Interval, start: datetime, end: datetime

|

|

|

|

|

|

):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Query bar data from RQData.

|

|

|

|

|

|

"""

|

|

|

|

|

|

symbol, exchange_str = vt_symbol.split(".")

|

|

|

|

|

|

rq_symbol = to_rq_symbol(vt_symbol)

|

|

|

|

|

|

if rq_symbol not in self.rq_symbols:

|

|

|

|

|

|

return None

|

|

|

|

|

|

|

|

|

|

|

|

end += timedelta(1) # For querying night trading period data

|

|

|

|

|

|

|

|

|

|

|

|

df = self.rq_client.get_price(

|

|

|

|

|

|

rq_symbol,

|

|

|

|

|

|

frequency=interval.value,

|

|

|

|

|

|

fields=["open", "high", "low", "close", "volume"],

|

|

|

|

|

|

start_date=start,

|

|

|

|

|

|

end_date=end

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

data = []

|

|

|

|

|

|

for ix, row in df.iterrows():

|

|

|

|

|

|

bar = BarData(

|

|

|

|

|

|

symbol=symbol,

|

|

|

|

|

|

exchange=Exchange(exchange_str),

|

|

|

|

|

|

interval=interval,

|

|

|

|

|

|

datetime=row.name.to_pydatetime(),

|

|

|

|

|

|

open_price=row["open"],

|

|

|

|

|

|

high_price=row["high"],

|

|

|

|

|

|

low_price=row["low"],

|

|

|

|

|

|

close_price=row["close"],

|

|

|

|

|

|

volume=row["volume"],

|

|

|

|

|

|

gateway_name="RQ"

|

|

|

|

|

|

)

|

|

|

|

|

|

data.append(bar)

|

|

|

|

|

|

```

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

## 策略开发

|

2019-04-12 08:01:58 +00:00

|

|

|

|

CTA策略模板提供完整的信号生成和委托管理功能,用户可以基于该模板自行开发策略。新策略可以放在根目录下vnpy\app\cta_strategy\strategies文件夹内,也可以放在用户运行的文件内(VN Station模式)。注意:策略文件命名是以下划线模式,如boll_channel_strategy.py;而策略类命名采用的是驼峰式,如BollChannelStrategy。

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

下面通过BollChannelStrategy策略示例,来展示策略开发的具体步骤:

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 参数设置

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

定义策略参数并且初始化策略变量。策略参数为策略类的公有属性,用户可以通过创建新的实例来调用或者改变策略参数。

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

如针对rb1905品种,用户可以创建基于BollChannelStrategy的策略示例,如RB_BollChannelStrategy,boll_window可以由18改成30。

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-12 08:01:58 +00:00

|

|

|

|

创建策略实例的方法有效地实现了一个策略跑多个品种,并且其策略参数可以通过品种的特征进行调整。

|

|

|

|

|

|

```

|

|

|

|

|

|

boll_window = 18

|

|

|

|

|

|

boll_dev = 3.4

|

|

|

|

|

|

cci_window = 10

|

|

|

|

|

|

atr_window = 30

|

|

|

|

|

|

sl_multiplier = 5.2

|

|

|

|

|

|

fixed_size = 1

|

|

|

|

|

|

|

|

|

|

|

|

boll_up = 0

|

|

|

|

|

|

boll_down = 0

|

|

|

|

|

|

cci_value = 0

|

|

|

|

|

|

atr_value = 0

|

|

|

|

|

|

|

|

|

|

|

|

intra_trade_high = 0

|

|

|

|

|

|

intra_trade_low = 0

|

|

|

|

|

|

long_stop = 0

|

|

|

|

|

|

short_stop = 0

|

|

|

|

|

|

```

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 类的初始化

|

2019-04-12 08:01:58 +00:00

|

|

|

|

初始化分3步:

|

|

|

|

|

|

- 通过super( )的方法继承CTA策略模板,在__init__( )函数传入CTA引擎、策略名称、vt_symbol、参数设置。

|

|

|

|

|

|

- 调用K线生成模块:通过时间切片来把Tick数据合成1分钟K线数据,然后更大的时间周期数据,如15分钟K线。

|

|

|

|

|

|

- 调用K线时间序列管理模块:基于K线数据,如1分钟、15分钟,来生成相应的技术指标。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

super(BollChannelStrategy, self).__init__(

|

|

|

|

|

|

cta_engine, strategy_name, vt_symbol, setting

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

self.bg = BarGenerator(self.on_bar, 15, self.on_15min_bar)

|

|

|

|

|

|

self.am = ArrayManager()

|

|

|

|

|

|

```

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 策略的初始化、启动、停止

|

2019-04-12 08:01:58 +00:00

|

|

|

|

通过“CTA策略”组件的相关功能按钮实现。

|

|

|

|

|

|

|

|

|

|

|

|

注意:函数load_bar(10),代表策略初始化需要载入10个交易日的历史数据。该历史数据可以是Tick数据,也可以是K线数据。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def on_init(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback when strategy is inited.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.write_log("策略初始化")

|

|

|

|

|

|

self.load_bar(10)

|

|

|

|

|

|

|

|

|

|

|

|

def on_start(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback when strategy is started.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.write_log("策略启动")

|

|

|

|

|

|

|

|

|

|

|

|

def on_stop(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback when strategy is stopped.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.write_log("策略停止")

|

|

|

|

|

|

```

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### Tick数据回报

|

2019-04-12 08:01:58 +00:00

|

|

|

|

策略订阅某品种合约行情,交易所会推送Tick数据到该策略上。

|

|

|

|

|

|

|

|

|

|

|

|

由于BollChannelStrategy是基于15分钟K线来生成交易信号的,故收到Tick数据后,需要用到K线生成模块里面的update_tick函数,通过时间切片的方法,聚合成1分钟K线数据,并且推送到on_bar函数。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def on_tick(self, tick: TickData):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback of new tick data update.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.bg.update_tick(tick)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### K线数据回报

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

收到推送过来的1分钟K线数据后,通过K线生成模块里面的update_bar函数,以分钟切片的方法,合成15分钟K线数据,并且推送到on_15min_bar函数。

|

|

|

|

|

|

```

|

|

|

|

|

|

def on_bar(self, bar: BarData):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback of new bar data update.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.bg.update_bar(bar)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 15分钟K线数据回报

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

负责CTA信号的生成,由3部分组成:

|

|

|

|

|

|

- 清空未成交委托:为了防止之前下的单子在上一个15分钟没有成交,但是下一个15分钟可能已经调整了价格,就用cancel_all()方法立刻撤销之前未成交的所有委托,保证策略在当前这15分钟开始时的整个状态是清晰和唯一的。

|

|

|

|

|

|

- 调用K线时间序列管理模块:基于最新的15分钟K线数据来计算相应计算指标,如布林带通道上下轨、CCI指标、ATR指标

|

|

|

|

|

|

- 信号计算:通过持仓的判断以及结合CCI指标、布林带通道、ATR指标在通道突破点挂出停止单委托(buy/sell),同时设置离场点(short/cover)。

|

|

|

|

|

|

|

|

|

|

|

|

注意:CTA策略具有低胜率和高盈亏比的特定:在难以提升胜率的情况下,研究提高策略盈亏比有利于策略盈利水平的上升。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def on_15min_bar(self, bar: BarData):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.cancel_all()

|

|

|

|

|

|

|

|

|

|

|

|

am = self.am

|

|

|

|

|

|

am.update_bar(bar)

|

|

|

|

|

|

if not am.inited:

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

self.boll_up, self.boll_down = am.boll(self.boll_window, self.boll_dev)

|

|

|

|

|

|

self.cci_value = am.cci(self.cci_window)

|

|

|

|

|

|

self.atr_value = am.atr(self.atr_window)

|

|

|

|

|

|

|

|

|

|

|

|

if self.pos == 0:

|

|

|

|

|

|

self.intra_trade_high = bar.high_price

|

|

|

|

|

|

self.intra_trade_low = bar.low_price

|

|

|

|

|

|

|

|

|

|

|

|

if self.cci_value > 0:

|

|

|

|

|

|

self.buy(self.boll_up, self.fixed_size, True)

|

|

|

|

|

|

elif self.cci_value < 0:

|

|

|

|

|

|

self.short(self.boll_down, self.fixed_size, True)

|

|

|

|

|

|

|

|

|

|

|

|

elif self.pos > 0:

|

|

|

|

|

|

self.intra_trade_high = max(self.intra_trade_high, bar.high_price)

|

|

|

|

|

|

self.intra_trade_low = bar.low_price

|

|

|

|

|

|

|

|

|

|

|

|

self.long_stop = self.intra_trade_high - self.atr_value * self.sl_multiplier

|

|

|

|

|

|

self.sell(self.long_stop, abs(self.pos), True)

|

|

|

|

|

|

|

|

|

|

|

|

elif self.pos < 0:

|

|

|

|

|

|

self.intra_trade_high = bar.high_price

|

|

|

|

|

|

self.intra_trade_low = min(self.intra_trade_low, bar.low_price)

|

|

|

|

|

|

|

|

|

|

|

|

self.short_stop = self.intra_trade_low + self.atr_value * self.sl_multiplier

|

|

|

|

|

|

self.cover(self.short_stop, abs(self.pos), True)

|

|

|

|

|

|

|

|

|

|

|

|

self.put_event()

|

|

|

|

|

|

```

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 委托回报、成交回报、停止单回报

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

在策略中可以直接pass,其具体逻辑应用交给回测/实盘引擎负责。

|

|

|

|

|

|

```

|

|

|

|

|

|

def on_order(self, order: OrderData):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback of new order data update.

|

|

|

|

|

|

"""

|

|

|

|

|

|

pass

|

|

|

|

|

|

|

|

|

|

|

|

def on_trade(self, trade: TradeData):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback of new trade data update.

|

|

|

|

|

|

"""

|

|

|

|

|

|

self.put_event()

|

|

|

|

|

|

|

|

|

|

|

|

def on_stop_order(self, stop_order: StopOrder):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Callback of stop order update.

|

|

|

|

|

|

"""

|

|

|

|

|

|

pass

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

## 回测研究

|

2019-04-12 08:01:58 +00:00

|

|

|

|

backtesting.py定义了回测引擎,下面主要介绍相关功能函数,以及回测引擎应用示例:

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 加载策略

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

把CTA策略逻辑,对应合约品种,以及参数设置(可在策略文件外修改)载入到回测引擎中。

|

|

|

|

|

|

```

|

|

|

|

|

|

def add_strategy(self, strategy_class: type, setting: dict):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.strategy_class = strategy_class

|

|

|

|

|

|

self.strategy = strategy_class(

|

|

|

|

|

|

self, strategy_class.__name__, self.vt_symbol, setting

|

|

|

|

|

|

)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 载入历史数据

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

负责载入对应品种的历史数据,大概有4个步骤:

|

|

|

|

|

|

- 根据数据类型不同,分成K线模式和Tick模式;

|

|

|

|

|

|

- 通过select().where()方法,有条件地从数据库中选取数据,其筛选标准包括:vt_symbol、 回测开始日期、回测结束日期、K线周期(K线模式下);

|

|

|

|

|

|

- order_by(DbBarData.datetime)表示需要按照时间顺序载入数据;

|

|

|

|

|

|

- 载入数据是以迭代方式进行的,数据最终存入self.history_data。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def load_data(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.output("开始加载历史数据")

|

|

|

|

|

|

|

|

|

|

|

|

if self.mode == BacktestingMode.BAR:

|

|

|

|

|

|

s = (

|

|

|

|

|

|

DbBarData.select()

|

|

|

|

|

|

.where(

|

|

|

|

|

|

(DbBarData.vt_symbol == self.vt_symbol)

|

|

|

|

|

|

& (DbBarData.interval == self.interval)

|

|

|

|

|

|

& (DbBarData.datetime >= self.start)

|

|

|

|

|

|

& (DbBarData.datetime <= self.end)

|

|

|

|

|

|

)

|

|

|

|

|

|

.order_by(DbBarData.datetime)

|

|

|

|

|

|

)

|

|

|

|

|

|

self.history_data = [db_bar.to_bar() for db_bar in s]

|

|

|

|

|

|

else:

|

|

|

|

|

|

s = (

|

|

|

|

|

|

DbTickData.select()

|

|

|

|

|

|

.where(

|

|

|

|

|

|

(DbTickData.vt_symbol == self.vt_symbol)

|

|

|

|

|

|

& (DbTickData.datetime >= self.start)

|

|

|

|

|

|

& (DbTickData.datetime <= self.end)

|

|

|

|

|

|

)

|

|

|

|

|

|

.order_by(DbTickData.datetime)

|

|

|

|

|

|

)

|

|

|

|

|

|

self.history_data = [db_tick.to_tick() for db_tick in s]

|

|

|

|

|

|

|

|

|

|

|

|

self.output(f"历史数据加载完成,数据量:{len(self.history_data)}")

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 撮合成交

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

载入CTA策略以及相关历史数据后,策略会根据最新的数据来计算相关指标。若符合条件会生成交易信号,发出具体委托(buy/sell/short/cover),并且在下一根K线成交。

|

|

|

|

|

|

|

|

|

|

|

|

根据委托类型的不同,回测引擎提供2种撮合成交机制来尽量模仿真实交易环节:

|

|

|

|

|

|

|

|

|

|

|

|

- 限价单撮合成交:(以买入方向为例)先确定是否发生成交,成交标准为委托价>= 下一根K线的最低价;然后确定成交价格,成交价格为委托价与下一根K线开盘价的最小值。

|

|

|

|

|

|

|

|

|

|

|

|

- 停止单撮合成交:(以买入方向为例)先确定是否发生成交,成交标准为委托价<= 下一根K线的最高价;然后确定成交价格,成交价格为委托价与下一根K线开盘价的最大值。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

下面展示在引擎中限价单撮合成交的流程:

|

|

|

|

|

|

- 确定会撮合成交的价格;

|

|

|

|

|

|

- 遍历限价单字典中的所有限价单,推送委托进入未成交队列的更新状态;

|

|

|

|

|

|

- 判断成交状态,若出现成交,推送成交数据和委托数据;

|

|

|

|

|

|

- 从字典中删除已成交的限价单。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def cross_limit_order(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Cross limit order with last bar/tick data.

|

|

|

|

|

|

"""

|

|

|

|

|

|

if self.mode == BacktestingMode.BAR:

|

|

|

|

|

|

long_cross_price = self.bar.low_price

|

|

|

|

|

|

short_cross_price = self.bar.high_price

|

|

|

|

|

|

long_best_price = self.bar.open_price

|

|

|

|

|

|

short_best_price = self.bar.open_price

|

|

|

|

|

|

else:

|

|

|

|

|

|

long_cross_price = self.tick.ask_price_1

|

|

|

|

|

|

short_cross_price = self.tick.bid_price_1

|

|

|

|

|

|

long_best_price = long_cross_price

|

|

|

|

|

|

short_best_price = short_cross_price

|

|

|

|

|

|

|

|

|

|

|

|

for order in list(self.active_limit_orders.values()):

|

|

|

|

|

|

# Push order update with status "not traded" (pending)

|

|

|

|

|

|

if order.status == Status.SUBMITTING:

|

|

|

|

|

|

order.status = Status.NOTTRADED

|

|

|

|

|

|

self.strategy.on_order(order)

|

|

|

|

|

|

|

|

|

|

|

|

# Check whether limit orders can be filled.

|

|

|

|

|

|

long_cross = (

|

|

|

|

|

|

order.direction == Direction.LONG

|

|

|

|

|

|

and order.price >= long_cross_price

|

|

|

|

|

|

and long_cross_price > 0

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

short_cross = (

|

|

|

|

|

|

order.direction == Direction.SHORT

|

|

|

|

|

|

and order.price <= short_cross_price

|

|

|

|

|

|

and short_cross_price > 0

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

if not long_cross and not short_cross:

|

|

|

|

|

|

continue

|

|

|

|

|

|

|

|

|

|

|

|

# Push order udpate with status "all traded" (filled).

|

|

|

|

|

|

order.traded = order.volume

|

|

|

|

|

|

order.status = Status.ALLTRADED

|

|

|

|

|

|

self.strategy.on_order(order)

|

|

|

|

|

|

|

|

|

|

|

|

self.active_limit_orders.pop(order.vt_orderid)

|

|

|

|

|

|

|

|

|

|

|

|

# Push trade update

|

|

|

|

|

|

self.trade_count += 1

|

|

|

|

|

|

|

|

|

|

|

|

if long_cross:

|

|

|

|

|

|

trade_price = min(order.price, long_best_price)

|

|

|

|

|

|

pos_change = order.volume

|

|

|

|

|

|

else:

|

|

|

|

|

|

trade_price = max(order.price, short_best_price)

|

|

|

|

|

|

pos_change = -order.volume

|

|

|

|

|

|

|

|

|

|

|

|

trade = TradeData(

|

|

|

|

|

|

symbol=order.symbol,

|

|

|

|

|

|

exchange=order.exchange,

|

|

|

|

|

|

orderid=order.orderid,

|

|

|

|

|

|

tradeid=str(self.trade_count),

|

|

|

|

|

|

direction=order.direction,

|

|

|

|

|

|

offset=order.offset,

|

|

|

|

|

|

price=trade_price,

|

|

|

|

|

|

volume=order.volume,

|

|

|

|

|

|

time=self.datetime.strftime("%H:%M:%S"),

|

|

|

|

|

|

gateway_name=self.gateway_name,

|

|

|

|

|

|

)

|

|

|

|

|

|

trade.datetime = self.datetime

|

|

|

|

|

|

|

|

|

|

|

|

self.strategy.pos += pos_change

|

|

|

|

|

|

self.strategy.on_trade(trade)

|

|

|

|

|

|

|

|

|

|

|

|

self.trades[trade.vt_tradeid] = trade

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 计算策略盈亏情况

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

基于收盘价、当日持仓量、合约规模、滑点、手续费率等计算总盈亏与净盈亏,并且其计算结果以DataFrame格式输出,完成基于逐日盯市盈亏统计。

|

|

|

|

|

|

|

|

|

|

|

|

下面展示盈亏情况的计算过程

|

|

|

|

|

|

|

|

|

|

|

|

- 浮动盈亏 = 持仓量 \*(当日收盘价 - 昨日收盘价)\* 合约规模

|

|

|

|

|

|

- 实际盈亏 = 持仓变化量 \* (当时收盘价 - 开仓成交价)\* 合约规模

|

|

|

|

|

|

- 总盈亏 = 浮动盈亏 + 实际盈亏

|

|

|

|

|

|

- 净盈亏 = 总盈亏 - 总手续费 - 总滑点

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def calculate_pnl(

|

|

|

|

|

|

self,

|

|

|

|

|

|

pre_close: float,

|

|

|

|

|

|

start_pos: float,

|

|

|

|

|

|

size: int,

|

|

|

|

|

|

rate: float,

|

|

|

|

|

|

slippage: float,

|

|

|

|

|

|

):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.pre_close = pre_close

|

|

|

|

|

|

|

|

|

|

|

|

# Holding pnl is the pnl from holding position at day start

|

|

|

|

|

|

self.start_pos = start_pos

|

|

|

|

|

|

self.end_pos = start_pos

|

|

|

|

|

|

self.holding_pnl = self.start_pos * \

|

|

|

|

|

|

(self.close_price - self.pre_close) * size

|

|

|

|

|

|

|

|

|

|

|

|

# Trading pnl is the pnl from new trade during the day

|

|

|

|

|

|

self.trade_count = len(self.trades)

|

|

|

|

|

|

|

|

|

|

|

|

for trade in self.trades:

|

|

|

|

|

|

if trade.direction == Direction.LONG:

|

|

|

|

|

|

pos_change = trade.volume

|

|

|

|

|

|

else:

|

|

|

|

|

|

pos_change = -trade.volume

|

|

|

|

|

|

|

|

|

|

|

|

turnover = trade.price * trade.volume * size

|

|

|

|

|

|

|

|

|

|

|

|

self.trading_pnl += pos_change * \

|

|

|

|

|

|

(self.close_price - trade.price) * size

|

|

|

|

|

|

self.end_pos += pos_change

|

|

|

|

|

|

self.turnover += turnover

|

|

|

|

|

|

self.commission += turnover * rate

|

|

|

|

|

|

self.slippage += trade.volume * size * slippage

|

|

|

|

|

|

|

|

|

|

|

|

# Net pnl takes account of commission and slippage cost

|

|

|

|

|

|

self.total_pnl = self.trading_pnl + self.holding_pnl

|

|

|

|

|

|

self.net_pnl = self.total_pnl - self.commission - self.slippage

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 计算策略统计指标

|

2019-04-12 08:01:58 +00:00

|

|

|

|

calculate_statistics函数是基于逐日盯市盈亏情况(DateFrame格式)来计算衍生指标,如最大回撤、年化收益、盈亏比、夏普比率等。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

df["balance"] = df["net_pnl"].cumsum() + self.capital

|

|

|

|

|

|

df["return"] = np.log(df["balance"] / df["balance"].shift(1)).fillna(0)

|

|

|

|

|

|

df["highlevel"] = (

|

|

|

|

|

|

df["balance"].rolling(

|

|

|

|

|

|

min_periods=1, window=len(df), center=False).max()

|

|

|

|

|

|

)

|

|

|

|

|

|

df["drawdown"] = df["balance"] - df["highlevel"]

|

|

|

|

|

|

df["ddpercent"] = df["drawdown"] / df["highlevel"] * 100

|

|

|

|

|

|

|

|

|

|

|

|

# Calculate statistics value

|

|

|

|

|

|

start_date = df.index[0]

|

|

|

|

|

|

end_date = df.index[-1]

|

|

|

|

|

|

|

|

|

|

|

|

total_days = len(df)

|

|

|

|

|

|

profit_days = len(df[df["net_pnl"] > 0])

|

|

|

|

|

|

loss_days = len(df[df["net_pnl"] < 0])

|

|

|

|

|

|

|

|

|

|

|

|

end_balance = df["balance"].iloc[-1]

|

|

|

|

|

|

max_drawdown = df["drawdown"].min()

|

|

|

|

|

|

max_ddpercent = df["ddpercent"].min()

|

|

|

|

|

|

|

|

|

|

|

|

total_net_pnl = df["net_pnl"].sum()

|

|

|

|

|

|

daily_net_pnl = total_net_pnl / total_days

|

|

|

|

|

|

|

|

|

|

|

|

total_commission = df["commission"].sum()

|

|

|

|

|

|

daily_commission = total_commission / total_days

|

|

|

|

|

|

|

|

|

|

|

|

total_slippage = df["slippage"].sum()

|

|

|

|

|

|

daily_slippage = total_slippage / total_days

|

|

|

|

|

|

|

|

|

|

|

|

total_turnover = df["turnover"].sum()

|

|

|

|

|

|

daily_turnover = total_turnover / total_days

|

|

|

|

|

|

|

|

|

|

|

|

total_trade_count = df["trade_count"].sum()

|

|

|

|

|

|

daily_trade_count = total_trade_count / total_days

|

|

|

|

|

|

|

|

|

|

|

|

total_return = (end_balance / self.capital - 1) * 100

|

|

|

|

|

|

annual_return = total_return / total_days * 240

|

|

|

|

|

|

daily_return = df["return"].mean() * 100

|

|

|

|

|

|

return_std = df["return"].std() * 100

|

|

|

|

|

|

|

|

|

|

|

|

if return_std:

|

|

|

|

|

|

sharpe_ratio = daily_return / return_std * np.sqrt(240)

|

|

|

|

|

|

else:

|

|

|

|

|

|

sharpe_ratio = 0

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 统计指标绘图

|

2019-04-12 08:01:58 +00:00

|

|

|

|

通过matplotlib绘制4幅图:

|

|

|

|

|

|

- 资金曲线图

|

|

|

|

|

|

- 资金回撤图

|

|

|

|

|

|

- 每日盈亏图

|

|

|

|

|

|

- 每日盈亏分布图

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def show_chart(self, df: DataFrame = None):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

if not df:

|

|

|

|

|

|

df = self.daily_df

|

|

|

|

|

|

|

|

|

|

|

|

if df is None:

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

plt.figure(figsize=(10, 16))

|

|

|

|

|

|

|

|

|

|

|

|

balance_plot = plt.subplot(4, 1, 1)

|

|

|

|

|

|

balance_plot.set_title("Balance")

|

|

|

|

|

|

df["balance"].plot(legend=True)

|

|

|

|

|

|

|

|

|

|

|

|

drawdown_plot = plt.subplot(4, 1, 2)

|

|

|

|

|

|

drawdown_plot.set_title("Drawdown")

|

|

|

|

|

|

drawdown_plot.fill_between(range(len(df)), df["drawdown"].values)

|

|

|

|

|

|

|

|

|

|

|

|

pnl_plot = plt.subplot(4, 1, 3)

|

|

|

|

|

|

pnl_plot.set_title("Daily Pnl")

|

|

|

|

|

|

df["net_pnl"].plot(kind="bar", legend=False, grid=False, xticks=[])

|

|

|

|

|

|

|

|

|

|

|

|

distribution_plot = plt.subplot(4, 1, 4)

|

|

|

|

|

|

distribution_plot.set_title("Daily Pnl Distribution")

|

|

|

|

|

|

df["net_pnl"].hist(bins=50)

|

|

|

|

|

|

|

|

|

|

|

|

plt.show()

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-06-11 01:58:32 +00:00

|

|

|

|

### 单策略回测示例

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

- 导入回测引擎和CTA策略

|

|

|

|

|

|

- 设置回测相关参数,如:品种、K线周期、回测开始和结束日期、手续费、滑点、合约规模、起始资金

|

|

|

|

|

|

- 载入策略和数据到引擎中,运行回测。

|

|

|

|

|

|

- 计算基于逐日统计盈利情况,计算统计指标,统计指标绘图。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

from vnpy.app.cta_strategy.backtesting import BacktestingEngine

|

|

|

|

|

|

from vnpy.app.cta_strategy.strategies.boll_channel_strategy import (

|

|

|

|

|

|

BollChannelStrategy,

|

|

|

|

|

|

)

|

|

|

|

|

|

from datetime import datetime

|

|

|

|

|

|

|

|

|

|

|

|

engine = BacktestingEngine()

|

|

|

|

|

|

engine.set_parameters(

|

|

|

|

|

|

vt_symbol="IF88.CFFEX",

|

|

|

|

|

|

interval="1m",

|

|

|

|

|

|

start=datetime(2018, 1, 1),

|

|

|

|

|

|

end=datetime(2019, 1, 1),

|

|

|

|

|

|

rate=3.0/10000,

|

|

|

|

|

|

slippage=0.2,

|

|

|

|

|

|

size=300,

|

|

|

|

|

|

pricetick=0.2,

|

|

|

|

|

|

capital=1_000_000,

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

engine.add_strategy(AtrRsiStrategy, {})

|

|

|

|

|

|

engine.load_data()

|

|

|

|

|

|

engine.run_backtesting()

|

|

|

|

|

|

df = engine.calculate_result()

|

|

|

|

|

|

engine.calculate_statistics()

|

|

|

|

|

|

engine.show_chart()

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-06-11 01:58:32 +00:00

|

|

|

|

### 投资组合回测示例

|

|

|

|

|

|

|

|

|

|

|

|

投资组合回测是基于单策略回测的,其关键是每个策略都对应着各自的BacktestingEngine对象,下面介绍具体流程:

|

|

|

|

|

|

|

|

|

|

|

|

- 创建回测函数run_backtesting(),这样每添加一个策略就创建其BacktestingEngine对象。

|

|

|

|

|

|

```

|

|

|

|

|

|

from vnpy.app.cta_strategy.backtesting import BacktestingEngine, OptimizationSetting

|

|

|

|

|

|

from vnpy.app.cta_strategy.strategies.atr_rsi_strategy import AtrRsiStrategy

|

|

|

|

|

|

from vnpy.app.cta_strategy.strategies.boll_channel_strategy import BollChannelStrategy

|

|

|

|

|

|

from datetime import datetime

|

|

|

|

|

|

|

|

|

|

|

|

def run_backtesting(strategy_class, setting, vt_symbol, interval, start, end, rate, slippage, size, pricetick, capital):

|

|

|

|

|

|

engine = BacktestingEngine()

|

|

|

|

|

|

engine.set_parameters(

|

|

|

|

|

|

vt_symbol=vt_symbol,

|

|

|

|

|

|

interval=interval,

|

|

|

|

|

|

start=start,

|

|

|

|

|

|

end=end,

|

|

|

|

|

|

rate=rate,

|

|

|

|

|

|

slippage=slippage,

|

|

|

|

|

|

size=size,

|

|

|

|

|

|

pricetick=pricetick,

|

|

|

|

|

|

capital=capital

|

|

|

|

|

|

)

|

|

|

|

|

|

engine.add_strategy(strategy_class, setting)

|

|

|

|

|

|

engine.load_data()

|

|

|

|

|

|

engine.run_backtesting()

|

|

|

|

|

|

df = engine.calculate_result()

|

|

|

|

|

|

return df

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 分别进行单策略回测,得到各自的DataFrame,(该DataFrame包含交易时间、今仓、昨仓、手续费、滑点、当日净盈亏、累计净盈亏等基本信息,但是不包括最大回撤,夏普比率等统计信息),然后把DataFrame相加并且去除空值后即得到投资组合的DataFrame。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

df1 = run_backtesting(

|

|

|

|

|

|

strategy_class=AtrRsiStrategy,

|

|

|

|

|

|

setting={},

|

|

|

|

|

|

vt_symbol="IF88.CFFEX",

|

|

|

|

|

|

interval="1m",

|

|

|

|

|

|

start=datetime(2019, 1, 1),

|

|

|

|

|

|

end=datetime(2019, 4, 30),

|

|

|

|

|

|

rate=0.3/10000,

|

|

|

|

|

|

slippage=0.2,

|

|

|

|

|

|

size=300,

|

|

|

|

|

|

pricetick=0.2,

|

|

|

|

|

|

capital=1_000_000,

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

df2 = run_backtesting(

|

|

|

|

|

|

strategy_class=BollChannelStrategy,

|

|

|

|

|

|

setting={'fixed_size': 16},

|

|

|

|

|

|

vt_symbol="RB88.SHFE",

|

|

|

|

|

|

interval="1m",

|

|

|

|

|

|

start=datetime(2019, 1, 1),

|

|

|

|

|

|

end=datetime(2019, 4, 30),

|

|

|

|

|

|

rate=1/10000,

|

|

|

|

|

|

slippage=1,

|

|

|

|

|

|

size=10,

|

|

|

|

|

|

pricetick=1,

|

|

|

|

|

|

capital=1_000_000,

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

dfp = df1 + df2

|

|

|

|

|

|

dfp =dfp.dropna()

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 创建show_portafolio()函数,同样也是创建新的BacktestingEngine对象,对传入的DataFrame计算如夏普比率等统计指标,并且画图。故该函数不仅能显示单策略回测效果,也能展示投资组合回测效果。

|

|

|

|

|

|

```

|

|

|

|

|

|

def show_portafolio(df):

|

|

|

|

|

|

engine = BacktestingEngine()

|

|

|

|

|

|

engine.calculate_statistics(df)

|

|

|

|

|

|

engine.show_chart(df)

|

|

|

|

|

|

|

|

|

|

|

|

show_portafolio(dfp)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

## 参数优化

|

2019-04-12 08:01:58 +00:00

|

|

|

|

参数优化模块主要由3部分构成:

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 参数设置

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

- 设置参数优化区间:如boll_window设置起始值为18,终止值为24,步进为2,这样就得到了[18, 20, 22, 24] 这4个待优化的参数了。

|

|

|

|

|

|

- 设置优化目标字段:如夏普比率、盈亏比、总收益率等。

|

|

|

|

|

|

- 随机生成参数对组合:使用迭代工具产生参数对组合,然后把参数对组合打包到一个个字典组成的列表中

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

class OptimizationSetting:

|

|

|

|

|

|

"""

|

|

|

|

|

|

Setting for runnning optimization.

|

|

|

|

|

|

"""

|

|

|

|

|

|

|

|

|

|

|

|

def __init__(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.params = {}

|

|

|

|

|

|

self.target_name = ""

|

|

|

|

|

|

|

|

|

|

|

|

def add_parameter(

|

|

|

|

|

|

self, name: str, start: float, end: float = None, step: float = None

|

|

|

|

|

|

):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

if not end and not step:

|

|

|

|

|

|

self.params[name] = [start]

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

if start >= end:

|

|

|

|

|

|

print("参数优化起始点必须小于终止点")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

if step <= 0:

|

|

|

|

|

|

print("参数优化步进必须大于0")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

value = start

|

|

|

|

|

|

value_list = []

|

|

|

|

|

|

|

|

|

|

|

|

while value <= end:

|

|

|

|

|

|

value_list.append(value)

|

|

|

|

|

|

value += step

|

|

|

|

|

|

|

|

|

|

|

|

self.params[name] = value_list

|

|

|

|

|

|

|

|

|

|

|

|

def set_target(self, target_name: str):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

self.target_name = target_name

|

|

|

|

|

|

|

|

|

|

|

|

def generate_setting(self):

|

|

|

|

|

|

""""""

|

|

|

|

|

|

keys = self.params.keys()

|

|

|

|

|

|

values = self.params.values()

|

|

|

|

|

|

products = list(product(*values))

|

|

|

|

|

|

|

|

|

|

|

|

settings = []

|

|

|

|

|

|

for p in products:

|

|

|

|

|

|

setting = dict(zip(keys, p))

|

|

|

|

|

|

settings.append(setting)

|

|

|

|

|

|

|

|

|

|

|

|

return settings

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 参数对组合回测

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

多进程优化时,每个进程都会运行optimize函数,输出参数对组合以及目标优化字段的结果。其步骤如下:

|

|

|

|

|

|

- 调用回测引擎

|

|

|

|

|

|

- 输入回测相关设置

|

|

|

|

|

|

- 输入参数对组合到策略中

|

|

|

|

|

|

- 运行回测

|

|

|

|

|

|

- 返回回测结果,包括:参数对组合、目标优化字段数值、策略统计指标

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def optimize(

|

|

|

|

|

|

target_name: str,

|

|

|

|

|

|

strategy_class: CtaTemplate,

|

|

|

|

|

|

setting: dict,

|

|

|

|

|

|

vt_symbol: str,

|

|

|

|

|

|

interval: Interval,

|

|

|

|

|

|

start: datetime,

|

|

|

|

|

|

rate: float,

|

|

|

|

|

|

slippage: float,

|

|

|

|

|

|

size: float,

|

|

|

|

|

|

pricetick: float,

|

|

|

|

|

|

capital: int,

|

|

|

|

|

|

end: datetime,

|

|

|

|

|

|

mode: BacktestingMode,

|

|

|

|

|

|

):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Function for running in multiprocessing.pool

|

|

|

|

|

|

"""

|

|

|

|

|

|

engine = BacktestingEngine()

|

|

|

|

|

|

engine.set_parameters(

|

|

|

|

|

|

vt_symbol=vt_symbol,

|

|

|

|

|

|

interval=interval,

|

|

|

|

|

|

start=start,

|

|

|

|

|

|

rate=rate,

|

|

|

|

|

|

slippage=slippage,

|

|

|

|

|

|

size=size,

|

|

|

|

|

|

pricetick=pricetick,

|

|

|

|

|

|

capital=capital,

|

|

|

|

|

|

end=end,

|

|

|

|

|

|

mode=mode

|

|

|

|

|

|

)

|

|

|

|

|

|

|

|

|

|

|

|

engine.add_strategy(strategy_class, setting)

|

|

|

|

|

|

engine.load_data()

|

|

|

|

|

|

engine.run_backtesting()

|

|

|

|

|

|

engine.calculate_result()

|

|

|

|

|

|

statistics = engine.calculate_statistics()

|

|

|

|

|

|

|

|

|

|

|

|

target_value = statistics[target_name]

|

|

|

|

|

|

return (str(setting), target_value, statistics)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

### 多进程优化

|

2019-04-12 08:01:58 +00:00

|

|

|

|

|

|

|

|

|

|

- 根据CPU的核数来创建进程:若CPU为4核,则创建4个进程

|

|

|

|

|

|

- 在每个进程都调用apply_async( )的方法运行参数对组合回测,其回测结果添加到results中 (apply_async是异步非阻塞的,即不用等待当前进程执行完毕,随时根据系统调度来进行进程切换。)

|

|

|

|

|

|

- pool.close()与pool.join()用于进程跑完任务后,去关闭进程。

|

|

|

|

|

|

- 对results的内容通过目标优化字段标准进行排序,输出结果。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

pool = multiprocessing.Pool(multiprocessing.cpu_count())

|

|

|

|

|

|

|

|

|

|

|

|

results = []

|

|

|

|

|

|

for setting in settings:

|

|

|

|

|

|

result = (pool.apply_async(optimize, (

|

|

|

|

|

|

target_name,

|

|

|

|

|

|

self.strategy_class,

|

|

|

|

|

|

setting,

|

|

|

|

|

|

self.vt_symbol,

|

|

|

|

|

|

self.interval,

|

|

|

|

|

|

self.start,

|

|

|

|

|

|

self.rate,

|

|

|

|

|

|

self.slippage,

|

|

|

|

|

|

self.size,

|

|

|

|

|

|

self.pricetick,

|

|

|

|

|

|

self.capital,

|

|

|

|

|

|

self.end,

|

|

|

|

|

|

self.mode

|

|

|

|

|

|

)))

|

|

|

|

|

|

results.append(result)

|

|

|

|

|

|

|

|

|

|

|

|

pool.close()

|

|

|

|

|

|

pool.join()

|

|

|

|

|

|

|

|

|

|

|

|

# Sort results and output

|

|

|

|

|

|

result_values = [result.get() for result in results]

|

|

|

|

|

|

result_values.sort(reverse=True, key=lambda result: result[1])

|

|

|

|

|

|

|

|

|

|

|

|

for value in result_values:

|

|

|

|

|

|

msg = f"参数:{value[0]}, 目标:{value[1]}"

|

|

|

|

|

|

self.output(msg)

|

|

|

|

|

|

|

|

|

|

|

|

return result_values

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

## 实盘运行

|

|

|

|

|

|

在实盘环境,用户可以基于编写好的CTA策略来创建新的实例,一键初始化、启动、停止策略。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### 创建策略实例

|

|

|

|

|

|

用户可以基于编写好的CTA策略来创建新的实例,策略实例的好处在于同一个策略可以同时去运行多个品种合约,并且每个实例的参数可以是不同的。

|

|

|

|

|

|

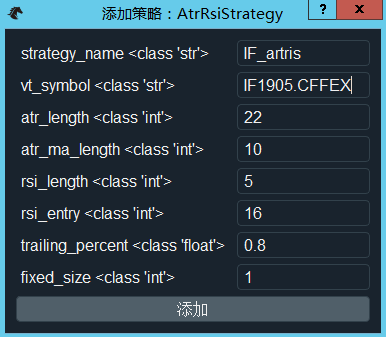

在创建实例的时候需要填写如图的实例名称、合约品种、参数设置。注意:实例名称不能重名;合约名称是vt_symbol的格式,如IF1905.CFFEX。

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

创建策略流程如下:

|

|

|

|

|

|

- 检查策略实例重名

|

|

|

|

|

|

- 添加策略配置信息(strategy_name, vt_symbol, setting)到strategies字典上

|

|

|

|

|

|

- 添加该策略要订阅行情的合约信息到symbol_strategy_map字典中;

|

|

|

|

|

|

- 把策略配置信息保存到json文件内;

|

|

|

|

|

|

- 在图形化界面更新状态信息。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def add_strategy(

|

|

|

|

|

|

self, class_name: str, strategy_name: str, vt_symbol: str, setting: dict

|

|

|

|

|

|

):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Add a new strategy.

|

|

|

|

|

|

"""

|

|

|

|

|

|

if strategy_name in self.strategies:

|

|

|

|

|

|

self.write_log(f"创建策略失败,存在重名{strategy_name}")

|

|

|

|

|

|

return

|

|

|

|

|

|

|

|

|

|

|

|

strategy_class = self.classes[class_name]

|

|

|

|

|

|

|

|

|

|

|

|

strategy = strategy_class(self, strategy_name, vt_symbol, setting)

|

|

|

|

|

|

self.strategies[strategy_name] = strategy

|

|

|

|

|

|

|

|

|

|

|

|

# Add vt_symbol to strategy map.

|

|

|

|

|

|

strategies = self.symbol_strategy_map[vt_symbol]

|

|

|

|

|

|

strategies.append(strategy)

|

|

|

|

|

|

|

|

|

|

|

|

# Update to setting file.

|

|

|

|

|

|

self.update_strategy_setting(strategy_name, setting)

|

2019-04-02 08:50:43 +00:00

|

|

|

|

|

2019-04-29 06:33:15 +00:00

|

|

|

|

self.put_strategy_event(strategy)

|

|

|

|

|

|

```

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

### 初始化策略

|

|

|

|

|

|

- 调用策略类的on_init()回调函数,并且载入历史数据;

|

|

|

|

|

|

- 恢复上次退出之前的策略状态;

|

|

|

|

|

|

- 调用接口的subcribe()函数订阅指定行情信息;

|

|

|

|

|

|

- 策略初始化状态变成True,并且更新到日志上。

|

|

|

|

|

|

|

|

|

|

|

|

```

|

|

|

|

|

|

def _init_strategy(self):

|

|

|

|

|

|

"""

|

|

|

|

|

|

Init strategies in queue.

|

|

|

|

|

|

"""

|

|

|

|

|

|

while not self.init_queue.empty():

|

|

|

|

|

|

strategy_name = self.init_queue.get()

|

|

|

|

|

|

strategy = self.strategies[strategy_name]

|

|

|

|

|

|

|

|

|

|

|

|

if strategy.inited:

|

|

|

|

|

|

self.write_log(f"{strategy_name}已经完成初始化,禁止重复操作")

|

|

|

|

|

|

continue

|

|

|

|

|

|

|

|

|

|

|

|

self.write_log(f"{strategy_name}开始执行初始化")

|

|

|

|

|

|

|

|

|

|

|

|

# Call on_init function of strategy

|

|